Nursing Home Evictions: Rights and Protections When Funds Run Out

Can a nursing home evict you when your money run away?

The fear of being force out of a nursing home after deplete your savings is a legitimate concern for many residents and their families. The short answer is: no, a nursing home can not lawfully evict you only because you’ve run out of private funds — if you qualify for Medicaid coverage. Nonetheless, the reality is more complex, and understand your rights is essential.

Federal protections against improper evictions

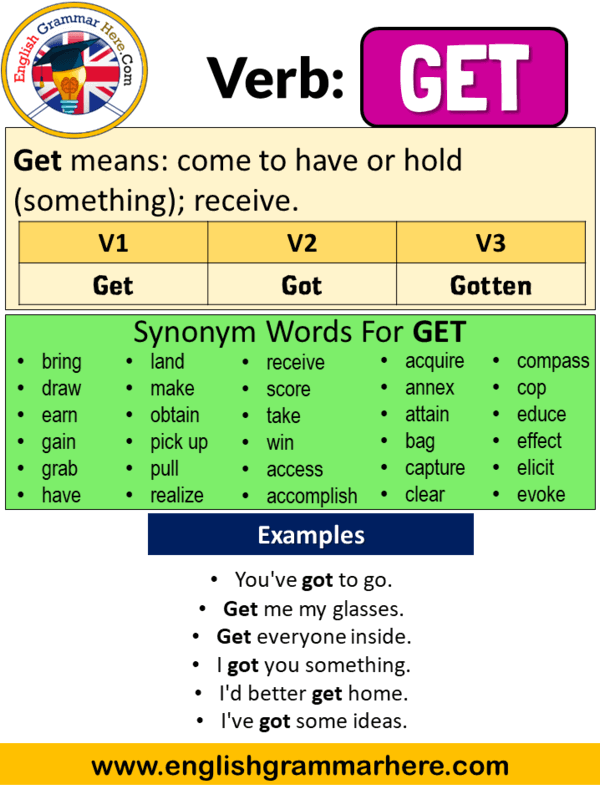

Nursing homes that accept Medicare and Medicaid funding — which include most facilities — must comply with federal regulations that protect residents from improper discharges. Under the nursing home reform act, facilities can solitary discharge residents for six specific reasons:

- The facility can not meet the resident’s needs

- The resident’s health has improved, make nursing home care unnecessary

- The resident endanger others’ safety

- The resident endanger others’ health

- The resident has fail to pay after reasonable notice

- The facility is close

Notably, transition from private pay to Medicaid is not among these legitimate reasons for discharge. If a nursing home attempts to evict you entirely because you havswitchedchMedicaidcaid, theyviolatedlate federal law.

The Medicaid safety net

Medicaid serves as the primary safety net for nursing home residents who exhaust their personal resources. When private funds run low, residents can will apply forMedicaidd coverage, which will continue to pay for care if eligibility requirements are meet.

To qualify for Medicaid nursing home coverage, you typically must:

- Meet your state’s income limits

- Have limited assets (commonly $$2000 or less for an individual, though some assets like your home may be exempt under certain conditions ))

- Require a nursing home level of care

It’s crucial to understand that Medicaid eligibility rules vary by state, and the application process should ideally begin before your private funds are wholly exhausted.

The reality of Medicaid discrimination

Despite legal protections, some nursing homes attempt to discriminate against Medicaid recipients. This happens becauseMedicaidd typically pay facilities less than private pay rates, create a financial incentive to prefer private pay residents.

Common tactics use by some facilities include:

- Claim they don’t have Medicaid beds available

- Suggest the resident need a higher level of care than they can provide

- Create documentation of behavioral issues to justify discharge

- Pressure families to pay privately or provide supplemental payments (which is illegal if the resident is mMedicaideligible )

These practices, while unluckily common, oftentimes violate federal and state laws that prohibit discrimination against Medicaid recipients.

The” mMedicaidpending ” eriod

A peculiarly vulnerable time is the period when you’ve applied foMedicaidid but haven’t however beeapprovedve — know as be” Medicaidipencede. Duringng this time, some nursing homes may pressure residents to leave, claim uncertainty about payment.

Yet, if you’ve submitted a compleMedicaidaid application and are likely to qualify, the nursing home should not discharge you while wait for approval. Many states have specific protections for residents during this period.

Medicaid certified vs. Private pay only facilities

It’s important to distinguish between Medicaid certify nursing homes and those that solitary accept private payment. If you’re in a facility that doesn’t participate in the Medicaid program at wholly, your options may be more limited when funds run out.

Before choose a nursing home, it’s wise to verify:

- Whether the facility accept Medicaid

- If they’ve a limited number of Medicaid beds

- Their policy regard residents who transition from private pay to Medicaid

Some facilities may require a certain period of private pay before accept Medicaid, which should be clear disclose in the admission agreement.

Understand admission agreements

The admission agreement you sign when enter a nursing home is a crucial document that outline your rights and the facility’s policies. Before signing, cautiously review any clauses relate to payment and discharge.

Watch out for problematic provisions such as:

- Requirements for a” responsible party ” o guarantee payment

- Mandatory private pay periods before Medicaid is accepted

- Waiver of rights to appeal discharge decisions

- Requirements for supplemental payments beyond what Medicaid cover

Many of these provisions may be unenforceable if they conflict with federal protections, but they can notwithstanding cause confusion and stress if include in the agreement.

Proper discharge procedures

Flush when a nursing home have a legitimate reason for discharge, they must follow specific procedures. Federal regulations require:

- Write notice at least 30 days before the proposal discharge( except in emergencies)

- Documentation of the specific reason for discharge

- Information about how to appeal the decision

- A safe and appropriate discharge plan

The facility must besides ensure that the new location is appropriate for your needs and must provide sufficient preparation to ensure a safe transition.

Steps to take if facing improper eviction

If you or a loved one face the threat of discharge after funds run low, take these steps:

1. Request written notice

Will ask for the discharge notice in writing, which must, will include the reason for discharge, the effective date, the location you’ll be will transfer to, and information about your right to will appeal.

2. File an appeal

You have the right to appeal a discharge decision to your state’s hearing agency. In most states, if you file an appeal within 10 days of receive the notice, you can remain in the facility until the appeal is decided.

3. Contact your long term care ombudsman

Every state have a long term care ombudsman program that advocate for nursing home residents. These ombudsmen can provide information about your rights and help resolve disputes with the facility.

4. Seek legal assistance

Contact your local legal aid office or an elder law attorney. Many legal aid organizations provide free assistance to low income seniors face nursing home discharge.

5. Report to regulatory agencies

File complaints with your state’s nursing home licensing agency and the centers for Medicare & Medicaid services (cms )if you believe federal regulations are being viviolated

Plan beforehand for nursing home costs

The best protection against discharge concerns is proper financial planning before nursing home admission. Consider these strategies:

Understand Medicaid eligibility

Learn your state’s Medicaid requirements comfortably in advance. Some asset transfers must be complete five years before apply (the ” ook back period “” to avoid penalties.

Consider long term care insurance

Long term care insurance can help cover nursing home costs and may provide more facility options than Medicaid solely.

Explore veterans benefits

Veterans and their spouses may qualify for VA aid and attendance benefit to help pay for long term care.

Source: elderguru.com

Consult an elder law attorney

An attorney specialize in elder law can help develop a comprehensive plan to protect assets while ensure care needs are meet.

Common misconceptions about nursing home payments

Several misconceptions exist about pay for nursing home care:

Medicare covers long term care

Medicare alone covers limited skilled nursing care follow a hospital stay, typically for up to 100 days. It does not cover long term custodial care, which make up the majority of nursing home services.

Transfer assets guarantee Medicaid eligibility

Transfer assets within five years of apply for Medicaid can trigger ineligibility periods. Medicaid have strict” look back ” ules design to prevent people from give away assets equitable to qualify.

Nursing homes can refuse to accept Medicaid

While a nursing home can choose not to participate in Medicaid at totally, those that do participate can not discriminate against residents who become eligible for Medicaid after admission.

State variations in protections

While federal law provide baseline protections, states may offer additional safeguards for nursing home residents. Some states have:

- Stronger discharge appeal processes

- More generous Medicaid eligibility criteria

- Specific prohibitions against require third party guarantors

- Requirements that facilities maintain a minimum percentage of Medicaid beds

Contact your state’s long term care ombudsman or department of aging to learn about specific protections in your area.

The role of family members

Family members play a crucial role in protect nursing home residents’ rights. If your loved one face potential discharge:

- Attend care planning meetings to stay informed about their status

- Monitor their care to ensure they’re not being neglect

- Keep detailed records of all communications with the facility

- Understand that you’re not lawfully require taking them into your home

- Know that you loosely aren’t personally liable for their nursing home bills unless you have sign as a guarantor

Conclusion: know your rights and plan leading

While nursing homes can not lawfully evict residents merely because they switch from private pay to Medicaid, improper discharges do occur. Understand your rights, plan leading financially, and know how to respond to discharge threats are your best protections.

Source: malmanlaw.com

Remember that federal law provide important safeguards, and resources like ombudsmen and legal aid attorneys are available to help. With proper preparation and advocacy, nursing home residents can maintain stable housing flush after their private funds are depleted.

The transition from private pay to Medicaid can be navigated successfully with advance planning, careful documentation, and knowledge of your legal protections. Don’t hesitate to seek help if you face resistance from a facility — the law is design to protect vulnerable residents from financial discrimination.

MORE FROM jobzesty.com